“Let me say that again: cut Social Security by $700 billion. … They want to raise the Social Security retirement age, which means a 13 percent cut in benefits for seniors who retires at age 67. Imagine. You work your whole life. Every single paycheck you’ve had, you’ve paid into that system. You thought you’d be able to retire with a little bit of dignity.”

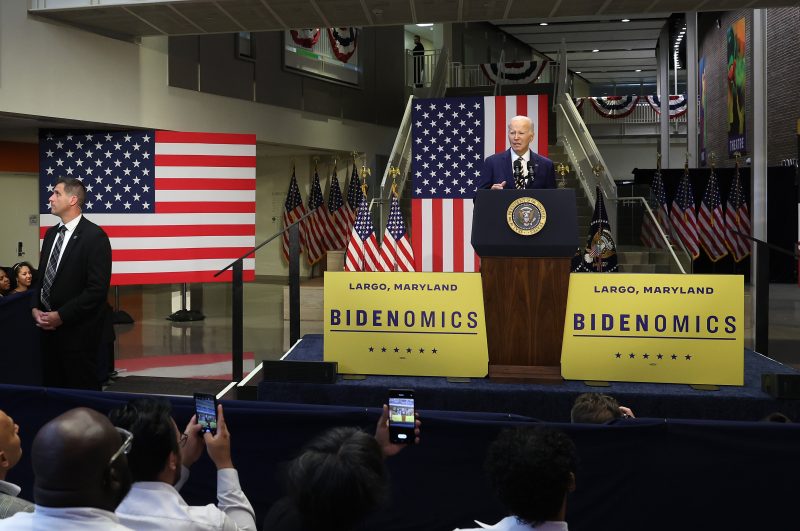

— President Biden, remarks on the economy in Maryland, Sept. 14

With some glee, President Biden last week held up a copy of what he called a budget crafted by “MAGA Republicans” and proceeded to bash it as out of touch with ordinary Americans. Biden made a number of claims but we’re going to focus on what he said about Social Security.

Social Security provides an interesting case study of the nation’s current political dysfunction. Since 1995, the trustees of the old-age retirement program have warned, year after year, that a financing crunch would occur early in the 2030s, resulting in an immediate cut in benefits, unless Congress took action to address the problem.

So the warnings began nearly three decades ago. There’s less than ten years to go. One would think that would generate action in Washington to deal with the problem — but Biden as president has offered no solution and Republicans, even when supposedly offering a fix, have ducked the issue as well.

In fact, there’s a catch to the GOP plan, offered by the Republican Study Committee (RSC), a House caucus that claims membership of about 70 percent of Republican representatives.

The 2023 version of the RSC budget would have started changing Social Security right away. But the 2024 version would not start changes until 2028, after the president elected in 2024 ends his or her term. That’s most likely because Donald Trump, the front-runner for the GOP nomination, has ruled out any changes to Social Security.

Let’s take a look.

Social Security was created in response to pervasive poverty during the Great Depression. It was designed to provide workers with a basic level of income in retirement, as well as disability pay and life insurance while they work.

About 78 percent of the 66 million beneficiaries are retired workers and dependents; the rest are disabled workers or survivors. The benefits are progressive, meaning lower-income workers get a relatively better deal than higher-income workers; however, workers making above a certain salary ($160,200 in 2023) don’t have to pay as much of their income into the system, though their benefits are capped, too.

About 96 percent of workers must pay a certain amount of their paycheck, generally 6.2 percent, an amount that is matched by their employers. This results in a 12.4 percent tax on income, as most economists would agree that the full amount is taken from the worker’s wage compensation.

Social Security is a pay-as-you-go system, which means that payments collected today are immediately used to pay benefits. That’s a big part of the reason for the coming financial crunch. Because Social Security was not prefunded, it depends heavily on the contributions of current workers. The baby-boom generation (people born between 1946 and 1964) will have fully hit retirement age by 2031, reducing the number of workers per retiree. Meanwhile, people are living longer and thus will collect benefits longer, while parents are not having as many children, which limits the pool of new workers.

On top of that, Social Security benefits are inflation-adjusted after initial receipt, a feature that is almost impossible to find in the U.S. annuity market.

Policymakers have known for years that a long-term solution would likely require a combination of fixes. Democrats have favored raising payroll taxes or raising the income level subject to tax. Republicans have preferred raising the retirement age from 67 or changing the rate at which benefits are adjusted for inflation. (President Barack Obama toyed with changing the inflation rate but backed off after being attacked by members of his own party.)

For Republicans, higher taxes are a non-starter. For Democrats, a higher retirement age is unfair to workers who earn money through manual labor. In 1983, when Ronald Reagan was president, the two parties came together on a Social Security deal that included both elements — but that was a much different era.

The 2024 RSC budget is vague on what changes would be made to the retirement age — it merely says the plan would “make modest adjustments to the retirement age for future retirees to account for increases in life expectancy.” Biden based his statement about a 13 percent cut on a GOP lawmaker’s statement that the plan called for the retirement age to rise to 69 years old, going up three months a year, starting with people who are currently 59.

Using estimates provided by the Social Security Administration, the Center on Budget and Policy Priorities says that raising the retirement age from 67 to 69 would result in a 13 percent reduction in monthly benefits. In other words, a person currently retiring at 67 with a monthly benefit of $1,000 under current law would receive $867 if the retirement age were raised to 69; he or she would have to delay retirement for two more years to receive $1,000 a month.

Rather than offering such details, the RSC budget spends a lot of ink attacking Biden for having offered no specific plan on Social Security, saying that in effect his plan calls for a 23 percent reduction in benefits in 2033. (Under law, that would happen if lawmakers do not act to shore up the program’s financing.) It notes that Biden voted for the 1983 Social Security amendments that previously fixed the system. “The RSC Budget calls on the President to stop lying, stop the political gamesmanship, and start seriously engaging with Republicans on sensible reforms to save the program,” the document says.

When Biden ran for president in 2020, he offered a plan that would have increased benefits for lower income Americans while also raising payroll taxes for high-income Americans to help finance the system. The Penn Wharton Budget Model found that the proposal would address 44 percent of the long-term funding gap, but Biden has never pushed to enact the plan into law.

Asked about the president’s current Social Security plan, a White House spokesman pointed to a brief section in Biden’s 2024 budget proposal: “The Administration is committed to protecting and strengthening Social Security and opposes any attempt to cut Social Security benefits for current or future recipients. The Administration looks forward to working with the Congress to responsibly strengthen Social Security by ensuring that high-income individuals pay their fair share.”

The RSC budget naturally rejects that approach, saying higher payroll taxes would shrink the economy and eliminate jobs. So there’s little chance of Biden working with Congress on this issue.

As for Biden’s statement that Social Security would be cut by $700 billion in the RSC budget, that figure adds in RSC’s proposals for disability insurance (which is also in trouble, and is another complex story).

The actual savings for the retirement part of Social Security would just be $224 billion over ten years. But, as we noted, that would not start until 2028 — after Biden (or Trump or whoever) leaves office. So the RSC’s solution, such as it is, would barely make a dent in the problem.

“Proposing $224 billion in cuts over 10 years, during which Social Security outlays are projected at $17.8 trillion, will do essentially nothing to prevent the exhaustion of the Social Security Trust Funds — perhaps buy a few extra weeks of solvency, but nothing beyond that,” said Andrew G. Biggs, a former principal deputy commissioner of Social Security, now at the American Enterprise Institute.

Miranda Dabney, the RSC’s communications director, did not respond to numerous queries.

Biggs said the RSC budgets have become vaguer on Social Security in recent years. “I see this as 100 percent a Trump effect,” he said. “It’s pretty amazing how he has shifted the dynamic on entitlement reform among Republicans. This is easy for him. It’s not as if he’s proposing tax increases. Instead, he’s just proposing nothing. But it does make life hard for budget-oriented conservatives like the RSC, since they have to try to balance the budget without addressing one of the single largest drivers of the budget deficit. And if it’s hard on paper, it’s harder in real life.”

Kathleen Romig, the Center on Budget and Policy Priorities’ director of Social Security and disability, said the policy choices have become less effective the longer lawmakers have dawdled on a solution. Eliminating the payroll tax cap entirely, without giving additional benefits in exchange for those additional payments, once would have eliminated the shortfall, she said, but that dramatic step would now only cover three-quarters of the gap, according to Social Security estimates.

Another solution would be to increase the payroll tax, but the latest estimate is that it would need to go up 3.44 percentage points, from 12.4 percent to 15.84 percent — a figure that increases year by year. Alternatively, benefits would need to be cut prospectively by more than 25 percent, the Social Security 2023 trustees report says.

Both are politically toxic proposals — but things will only get worse if nothing is done now.

“If we wait until the 2030s, it’s all over,” said Charles Blahous, a former Social Security trustee now at George Mason University’s Mercatus Center. “At that point, there is no plausible likelihood that lawmakers could repair Social Security’s finances in a way that preserves its design as a self-financing earned benefit. They would have to abandon self-financing, meaning bail out the program from general revenues, thereby terminating the link between contributions and benefits. Gone forever would be any sense in which workers earned their Social Security benefits, and with it, the unique political protections Social Security has always enjoyed.”

Biden’s attack on the RSC budget might seem like a sharp political play but, policy wise, it’s shortsighted. Ironically, the RSC’s proposal is no profile in political courage either. This conservative group of Republicans propose to delay implementing their Social Security plan apparently to avoid offending Trump — so the net result is that the RSC budget buys only a few weeks of time to stem the benefit cuts that would come from doing nothing.

(About our rating scale)

Send us facts to check by filling out this form

Sign up for The Fact Checker weekly newsletter

The Fact Checker is a verified signatory to the International Fact-Checking Network code of principles