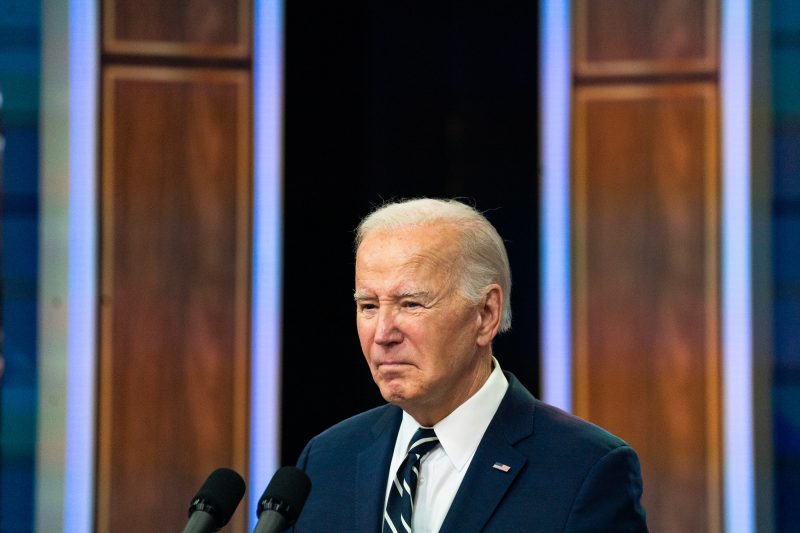

President Biden has a story he wants to tell voters about the economy, one of consistent job growth over the course of his presidency and of a pandemic recovery that has led the world.

Inflation keeps getting in the way.

Last week’s inflation report showed consumer prices rising 3.5 percent from March 2023 to March 2024. This continued a string of surprises this year, suggesting a resurgence in inflation after signs had pointed in the other direction.

Biden administration officials have noted that the inflation rate has fallen since its earlier peak, but the latest numbers show it has not fully cooled. For now, it is moving in the wrong direction and remains above the Federal Reserve’s target of 2 percent.

Despite unemployment at a half-century low, the president’s economic job approval is net negative by a significant margin. The RealClearPolitics average shows that he is net negative by 18 percentage points on his handling of the economy and by 27 percentage points on how he’s dealt with inflation.

Political strategists in both parties have reported that voters repeatedly point to higher prices as a source of their unhappiness about the state of the country. The cost of everyday items — gasoline, food, housing — hits them constantly.

It’s hard to persuade voters to look on the sunny side when they are feeling the squeeze of higher prices on their household budgets. Voters’ common refrain is summed up as: Things cost too much.

Gasoline prices are rising once again, a typical occurrence as summer approaches. Although they are below their peak during the Biden presidency, they are significantly higher than when he took office. In early 2021, average gas price was $2.42. Today it is about $3.50, according to the U.S. Energy Information Agency.

Food prices are taking another bite out of household incomes. From 2019 to 2023, food prices rose by 25 percent, according to the U.S. Department of Agriculture.

Food costs accounted for 11.3 percent of disposable income in 2022, according to the most recent USDA analysis. That is the highest it has been since 1991, when families spent 11.4 percent of disposable income on food.

A dozen eggs now cost, on average, about $2.99, according to one indicator. That compares to an inflation-adjusted $2.09 per dozen in 2020.

Higher interest rates have meant more costly home mortgages. Mortgage rates began to ease but that has stalled or even begun to reverse. The Wall Street Journal carried a story on Friday that looked at the impact on middle-income families. The headline read: “Stay Put or Pay Up: Home Buyers Lose Hope for Lower Rates.”

The story said that, in March, a median-income family could afford a house costing no more than $416,000, given current interest rates and assuming a down payment of 20 percent. Three years ago, when mortgage rates were lower, that family could have bought a house valued at $561,000.

Other unexpected and unavoidable costs are hitting family pocketbooks. Car insurance is one example, with rates up 22.2 percent in the past year, the biggest increase since 1976. In Nevada, a presidential battleground state, auto insurance rates were up 38 percent over the previous year, according to a CNN report.

My colleague Heather Long posted on X earlier this year that, as of February, household repair costs had risen 18 percent over the previous year and nonprescription drugs were up 9 percent. Both, she noted on the social media platform formerly known as Twitter, were the highest such increases ever recorded.

Biden issued a statement last week after the March consumer price index report. He stressed that inflation had declined by more than 60 percent from its peak but said, “We have more to do to lower costs for hard-working families.” He added, “Fighting inflation remains my top economic priority.”

But presidents have few weapons in the fight against inflation. Jason Furman, an economist at Harvard University and chairman of the Council of Economic Advisers in the Obama administration, said 90 percent of controlling inflation is the job of the Federal Reserve. “The White House mostly has to figure out the best message to get through it, without a lot of tools to change the reality,” he said.

Biden has pushed policies aimed at lowering the cost of prescription drugs and he has gone after junk fees that companies add to things like airline tickets, car rentals and event tickets. He announced initiatives to provide assistance for home buyers in his State of the Union address, but they are going nowhere.

Twice this past week, the administration announced actions to reduce student debt, efforts aimed to shore up support among younger voters. But those policies affect the pocketbooks only of those who qualify while adding future costs to the government. And they have drawn criticism for helping some who went to college at the expense of others who never went to college.

The Fed would cut interest rates for two reasons — to head off a recession if one was looming or because inflation had eased enough to give officials confidence that lower rates would not reignite another inflationary round. Neither condition exists right now.

There is no recession on the horizon, after a long period of predictions that interest rate hikes could or would bring about a recession. And now prices are rising more rapidly than expected.

Economists think it’s doubtful there will be a rate cut in June, as had been assumed a few months ago. A reduction in rates in September, though perhaps warranted economically by then, could be too close to the election, leaving Federal Reserve Board Chair Jerome H. Powell open to criticism that the Fed was acting to help Biden politically.

The 2024 election will be fought over more than economic issues. The biggest political story of the past week was the decision by the Arizona Supreme Court to resurrect an 1864 law that bans abortions except in the case of a danger to the life of the mother and that imposes penalties on those who provide abortions.

The decision will ensure that abortion will be a key issue in one of the most important battlegrounds in November, with the likelihood of an abortion referendum on the ballot. Vice President Harris, who has led the administration’s messaging on abortion for the past two years, flew to Arizona on Friday to highlight the state court action.

Biden has also made clear he will continue to focus on former president Donald Trump as a threat to democracy. Trump has said a second term would be an opportunity for retribution against his adversaries, and he has never retreated from his false claim that the 2020 election was stolen.

In the 2022 midterm elections, pre-election polls suggested that inflation and the economy were the biggest issues on the minds of voters, which led to predictions of sweeping Republican gains.

In the end, however, abortion and threats to democracy combined to motivate Democratic voters. Republicans came out of the midterms disappointed, gaining only a tiny majority in the House, failing to take control of the Senate and losing several contested elections for governor.

Biden hopes that may be the case again this November. But for him, the uptick in the inflation rate has come at just the wrong moment. Many Americans are saying they think things were better economically under Trump. The current president doesn’t have much time to change those perceptions — even as he tries to force the election onto other terrain.