House Republicans are preparing to unveil what they call the ‘strongest’ anti-Chinese government bill in U.S. history Thursday.

If passed, it would dramatically curtail trade with China in areas critical to national security, including telecommunications, pharmaceuticals and military technology.

On the cultural front, the bill would establish avenues for the promotion of U.S.-backed ideals and points critical of Beijing’s ruling Chinese Communist Party (CCP) within China’s own borders.

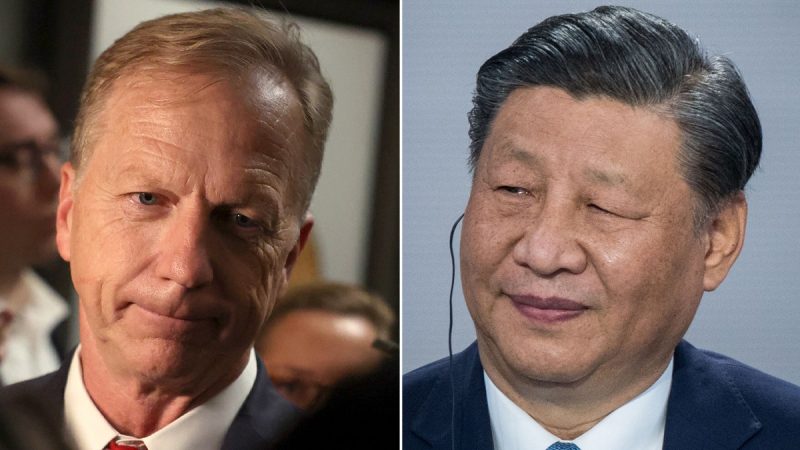

Republican Study Committee (RSC) Chairman Kevin Hern, R-Okla., is leading the proposal, the Countering Communist China Act, which is being promoted by his 175-member group.

‘We must treat the CCP like the threat they are and use every tool at our disposal to combat their influence in our schools and our government,’ Hern told Fox News Digital.

‘This bill targets the CCP in a comprehensive and vigorous way, putting American safety and economic security first. It’s the strongest legislation against the CCP ever introduced to Congress, and for good reason.’

Rep. Joe Wilson, R-S.C., RSC’s National Security and Foreign Policy Task Force chairman, told Fox News Digital, ‘The CCP dictatorship in China run by Xi Jinping threatens global security, endangers our allies and is destroying the future of the people of China.’

The bill would restrict outbound investments in Chinese technology companies, while also placing trade restrictions on Beijing-backed companies dealing with military tech and surveillance.

It would also call for expanded U.S. production in supply chains dealing with medicine and critical minerals, both of which are heavily dominated by China.

The bill would not fully sever U.S.-China trade, however. Trade in sectors unrelated to national security, such as agricultural goods and toys, is not covered by the proposed restrictions.

Hern’s comprehensive legislation is also aimed at addressing the fentanyl crisis by levying sanctions on Chinese officials and entities linked to the international flow of the lethal drug into the U.S. It also calls for empowering U.S. citizens to sue Chinese government officials after the fentanyl death of a loved one.

Amid the restrictions, the bill also seeks to promote pro-democracy viewpoints to both people in China and the Chinese-speaking diaspora.

A summary of the bill obtained by Fox News Digital called for the formation of ‘new Mandarin Chinese language social media accounts, radio stations, videos, etc. to amplify the voices of Chinese people as they highlight CCP human rights abuses, and fight for democracy.’

It would be a significant initiative given China’s crackdown on information within its borders, including internet restrictions on content critical of the CCP.

U.S.-China relations, especially on trade, have suffered from rising geopolitical tensions. They primarily stem from Beijing’s aggression in the South China Sea, both countries’ relationship with Taiwan and longstanding allegations of intellectual property theft by CCP-backed entities.