For today’s daily, have a listen to Mish on Real Vision with Ash Bennington as they cover:

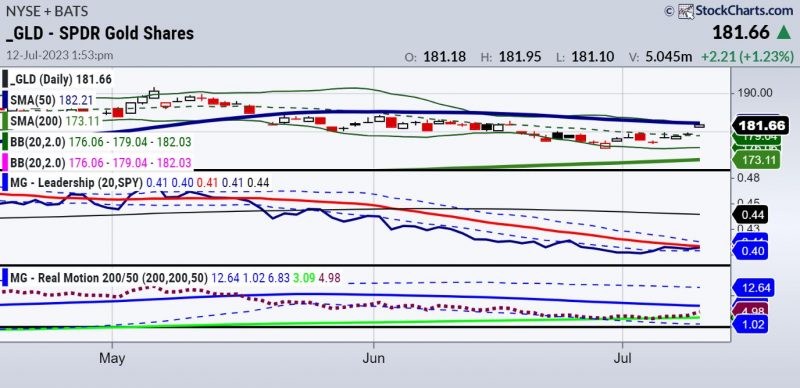

CPI Inflation and market reactionWhat’s going on in the Russell and Nasdaq How the Fed will respondBondsMetalsInflation

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish talks day-trading tactics, currency pairs, gold, oil, and sugar futures in this video from CMC Markets.

Mish and Angie Miles talk tech, small caps and one new stock in this appearance on Business First AM.

Mish examines the old adage “Don’t Fight the Fed” in this interview on Business First AM.

Mish and Charles Payne talk the Fed, CPI, Inflation, yields, bonds and sectors she likes on Fox Business’ Making Money with Charles Payne.

Mish, Brad Smith and Diane King Hall discuss and project on topics like earnings, inflation, yield curve and market direction in this appearance on Yahoo Finance.

Mish reviews her first-quarter trades in this appearance on Business First AM.

Mish talks women in the trading space and covers a wide variety of ideas in this interview for FreeFX.

Mish runs through bonds, modern family, commodities ahead of PCE on Benzinga.

Coming Up:

July 12: Mario Nawfal Twitter Spaces

July 13: TD Ameritrade

ETF Summary

S&P 500 (SPY): 440-450 range.Russell 2000 (IWM): Can it hold 190.Dow (DIA): 34,000 pivotal.Nasdaq (QQQ): 370 pivotal support.Regional Banks (KRE): 42.00-44.00 range.Semiconductors (SMH): 150 support.Transportation (IYT): Closed unchanged-interesting.Biotechnology (IBB): 121-135 range.Retail (XRT): Closed red-even more interesting that IYT unchanged.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education